Business Cash Advance

Flexible finance designed as an alternative to traditional bank loans.

What is a Business Cash Advance?

A Business Cash Advance is a flexible funding option for Irish SMEs. You get access to funding based on your future card sales with no interest, fixed terms, or repayments. Repayments are deducted automatically from your daily credit and debit card transactions.

How it works:

If you process €10,000/month in card sales, you may qualify for the same amount in funding. A percentage (typically 5–15%) is deducted from daily card sales until your advance is fully repaid.

Why choose 365 Finance?

- No fixed monthly payments or interest

- No collateral or business plans required

- Fast approvals within 24 hours

- Ideal for Irish businesses with card turnover

Who is it for?

This solution is ideal for businesses, retailers, hospitality venues, salons, and service providers who accept card payments.

Am I eligible for a Merchant cash advance?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed €10,000?

You’re eligible

Get a quoteYou must take at least €10,000 per month in card sales and have been trading for at least 6 months

Request a callbackHow much money does your business need?

€60,000

funding received

€100

for every card transaction

85% = €85

goes to your account

15% = €15

goes to 365 finance

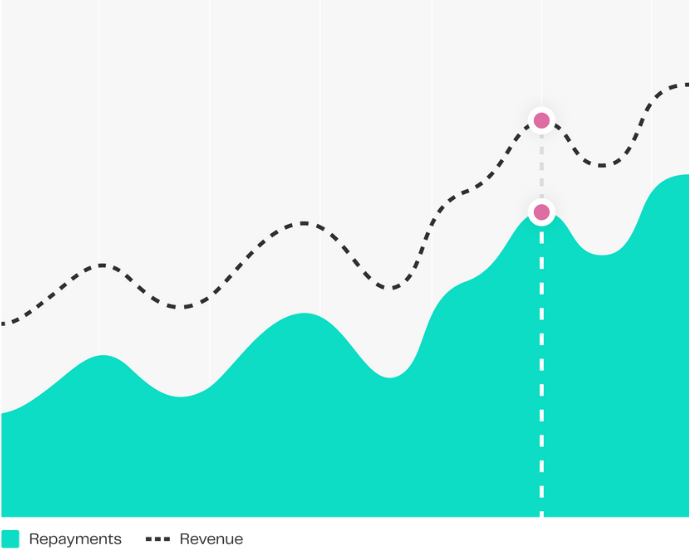

Unlike a traditional loan, repayments mirror the ups and downs of your business.

Repayments are automatic and based on a small percentage of your monthly card sales. So when business is slow, repayments are low – and when business is good, you pay a bit more. Not only does this remove the stress of a traditional high street loan, it is also perfect for seasonal businesses.

How Merchant Cash Advance repayments work

1

Agree fixed percentage

Agree a fixed percentage of your credit and debit card sales to repay the business cash advance (typically between 5% and 15% of your card sales)

2

Make card sales

Sell to your customers on your credit and debit card terminals.

3

Automatic repayments

The pre-agreed percentage is automatically deducted from your daily transactions at point of sale and you will.

4

Get Money into your account

This is automated so there is no change to the time it takes for you to receive your money.

5

Daily Sales reduce balance outstanding

The daily amount deducted then reduces the balance outstanding on the business cash advance.

6

Collections Stop automatically

Collections stop automatically once the cash advance has been repaid in full.